Poster family for Habitat for Humanity says deal for promised home feels like ‘bait and switch’

Two low-income families are suing Habitat for Humanity of Greater Vancouver for allegedly breaching oral contracts promising them a path to home ownership.

Two low-income families are suing Habitat for Humanity of Greater Vancouver for allegedly breaching oral contracts promising them a path to home ownership.

Two couples named in the civil lawsuit say they signed papers and started paying an interest-free mortgage issued by the non-profit group, but now fear they may never actually own the properties they live in. They have no documents outlining the terms of the original deals .

One family was shocked to learn after six years that the home they thought they were purchasing for $255,000 will now cost more than double that price. In turn, Habitat for Humanity says its policy doesn’t allow for prices below market value.

As for any documents that show the original home value as $255,000, neither side can produce them.

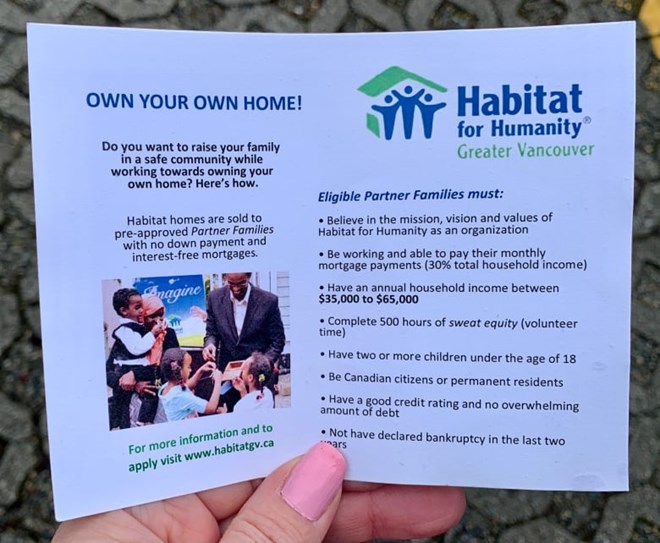

There are 58 chapters of Habitat for Humanity in Canada. The non-profit organization was created to offer newcomers a ‘hand up’ to home ownership, to break poverty cycles. They do this by acting as the bank and offering a home for no down payment or interest to families that meet their criteria.

Shahra-sad Mohamed Warsame Ali and her husband Ali Hassan Hersi signed on with Habitat and passed the non-profit’s strict vetting process six years ago.

The Somali couple were handed keys to their new three-bedroom townhouse and their smiles illustrate leaflets used to promote the non-profit to other applicants.

“Oh my goodness we were so happy! We were happy about the prospect of owning a home,” said Hersi who fled the civil war in Somalia at 17.

Shahra-sad Mohamed Warsame Ali and her family are pictured in a pamphlet for Habitat for Humanity. The photo captures the day they received a box with the ‘key of hope’ to their new Burnaby home. (Yvette Brend/CBC News)

“They told us that you are the perfect family that we are looking for.”

In 2015 they moved into their townhouse in a 27-unit complex in Burnaby.

They soon worked off the required 500 “sweat equity” hours at Habitat’s ReStore. And they paid the monthly $1,020 fee believing it was going toward their mortgage.

They got jobs: he at Bell Mobility and she at LifeLabs. Then after a year of tenancy they again asked to sign the mortgage and have the property title passed over to them — as agreed in 2015.

But then they met a wall.

Now they say they aren’t confident they really own a home.

The meeting with no record

The couple says they attended a meeting on Feb. 13, 2015, at Habitat’s office with then CEO Tim Clark and Clare Davey, head of Family Services and special Projects with Habitat.

In a civil statement of claim filed with B.C. In The Supreme Court this week the couple alleges they were not allowed to bring a mobile phone to that meeting. Figures were written on a white board. The civil claim says there was an oral agreement that the townhouse would be valued at $255,000.

They claim that documents were signed — but copies were never shared, despite requests.

There are 27 units in this Burnaby complex on Government Road owned by Habitat for Humanity. Nine of the residents say they do not hold mortgages or title to the homes they live in. (Yvette Brend/CBC News Vancouver)

By the summer of 2016 they asked the new Habitat CEO for the mortgage and title to their home as promised in a tenancy agreement.

“We’ve been in limbo ever since,” said Hersi.

Years passed with no mortgage, as housing prices soared.

Finally in 2020 the non-profit proposed a mortgage, now valuing the home at $590,000, more than double the initial $255,000 value.

“I asked — is this a bait and switch?” said Hersi.

Oral agreements are enforceable in B.C. but it must be proven that they exist and that terms were agreed to. They are not common in property matters, nor are they standard for Habitat for Humanity, according to the non-profit.

The situation has caused much stress, the couple says.

“We wanted a better life for our kids … and all of that now is uncertain,” Warsame Ali said.

“If anybody had told this story before we applied we wouldn’t have partnered up with them … I wouldn’t wish this on anyone. I can’t sleep.”

Habitat CEO Dennis Coutts took over in 2016 and blames delays on an “internal policy review.”

“In retrospect, would it have been better had we been able to do the mortgages earlier? Clearly it would have been better for everybody.”

But he says families suffered no financial harm and were offered a property value based on 2017 prices.

As for any oral agreement in 2015, he says: “I can’t verify that commitment. There is nothing in writing. There’s nothing in the files that I can see. And [agreeing to below market value] would have been contrary to the policies of Habitat for Humanity.”

Owners can sell their homes back to Habitat for about 65-70 per cent of the equity paid, after taxes, utilities and a 10 per cent fee is subtracted.

“It’s a hand up program, not a hand out,” said Coutts.

Families received a “blessing” and “thousands” are “standing in line and wanting this opportunity,” said Coutts.

Yvette Brend is a Vancouver journalist. Yvette.Brend@cbc.ca or on Twitter or Instagram @ybrend